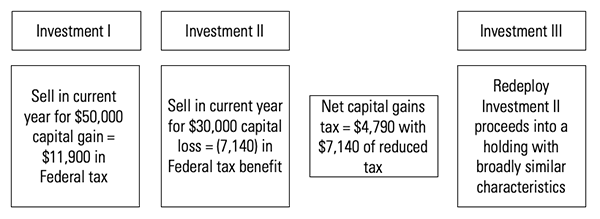

Investment portfolios that are balanced to various economic and inflationary environments will at times contain certain holdings with unrealized capital losses. Tax loss harvesting is a tactical portfolio strategy to sell these holdings to capture the capital losses, which can then be used to offset the capital gains realized elsewhere in the portfolio. Further, the losses can be used to offset ordinary income up to $3,000 if there is an overall capital loss for the year.

Once the holding is sold for a loss, the money can then be reinvested in a holding that has similar overall characteristics but is not “substantially identical.” A substantially identical holding would violate the wash sale rule which states that if you sell a holding for a loss and buy the same or substantially identical holding within 30 days before or after the sale, the loss is typically disallowed for current tax purposes.

A simple illustration:

Essential Partners utilizes a leading technology platform for monitoring and trading client partners’ accounts to actively tax loss harvest. For instance, the technology application results in automated, proactive monitoring and recommendations for tax loss harvesting opportunities. The recommendations are provided to Essential Partners daily, who then applies a human, analytical lens to ensure the action is warranted given each client partner’s unique situation. This technology is used in coordination with Essential Partner’s investment allocations to designate alternative holdings to purchase as tax loss harvesting is executed.

Empirical research has demonstrated that active tax loss harvesting can increase annual, after-tax returns by 0.75-1.5%. While on the surface this appears to be a small difference, consider the following examples:

- No tax loss harvesting scenario:

- $1,000,000 invested with a 5% after tax return over 15 years would result in $2,078,928

- Tax loss harvesting benefit of 1.5% scenario:

- $1,000,000 invested with a 6.5% after tax return over 15 years would result in $2,571,841

- The difference between these two scenarios in this hypothetical example is nearly $500,000 or 24%

Investment advisory services offered through Essential Partners, a registered investment advisor. This document contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed will come to pass. Investing in financial markets involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

An Empirical Evaluation of Tax Loss Harvesting Alpha, FAJ, Chaudhuri, Burnham, Lo