- Have you considered the mindset and thought process differences between operating a business for personal cash flow vs. earning an investment return?

- Have you performed a comprehensive financial forecast for you and your family considering your financial situation post-sale?

- Do you understand your investment options and a range of investment returns? Is your nest egg large enough?

- Does your salesperson/broker have a rigorous framework to navigate an uncertain future without taking undue risk, while achieving your cash flow objectives?

Owning, managing and growing a business requires industry and business specific knowledge along with discipline, risk-taking, creativity, resiliency and many other traits. The result is that the business provides cash flow for the owner’s family to live.

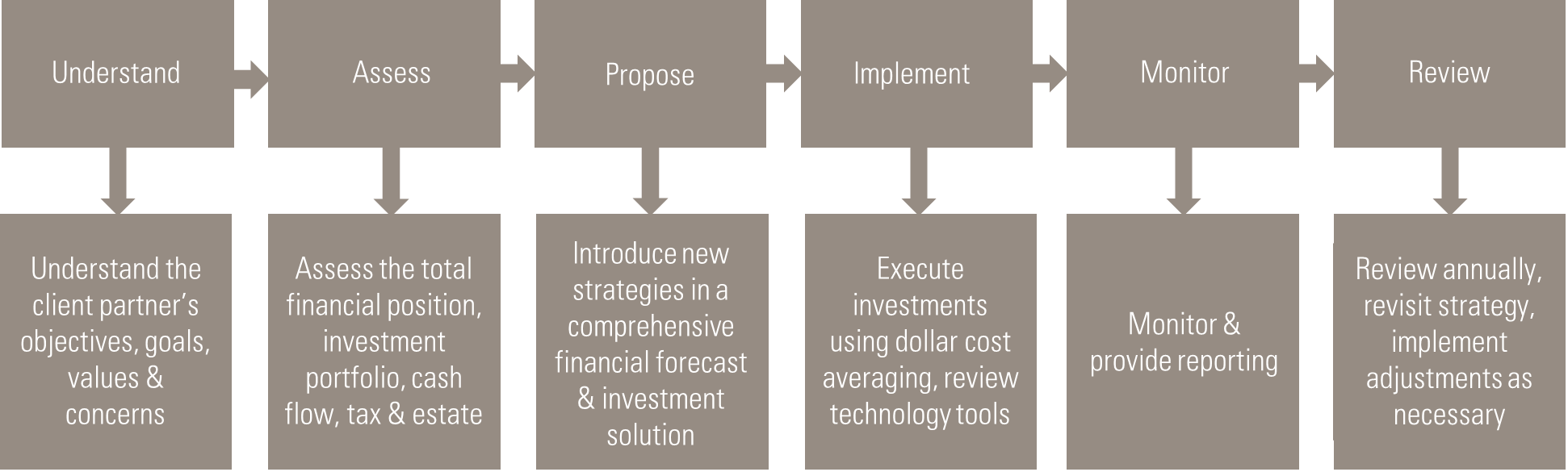

After a business sale or liquidity event, the experience, process and skills required to protect and grow the proceeds is very different. Essential Partners helps business owners transition from a business income mindset to a wealth-based mindset. During this transition, we take the time to understand our client partner’s objectives, family dynamics and concerns.

Cash flow planning is critical in any business, and this is true for families post-sale. At Essential Partners, we execute a comprehensive family financial forecast before and after a liquidity event. Tax mitigation strategies working in collaboration with CPA partners, play an important role.

In a wealth-based mindset, the “revenue” of the forecast is driven by investment returns but there is substantial confusion regarding returns and the minimum nest egg required to maintain a family’s expense base. Will I earn 2% or 10% or 5%? Do I have enough money to live off my investment returns, or will I have to spend some of my nest egg? What is the plan if the stock market declines? We provide scenario analysis to address these questions with specifics and disciplined, pro-active planning.

We further help our client partners understand that cash flow to the family does not need to come from high income producing investments such as high yield bonds or high dividend yielding stocks. Oftentimes, we find that people are taking excessive risk to generate current cash flow as opposed to executing total return-based distributions for current cash flow, which can also be more tax efficient.

A thorough financial forecast is the foundation of a properly designed investment strategy. For example, a family with modest expenses yet high investable assets should not take excess risk or endure wild volatility in an attempt to maximize returns with no clear objective to do so.

Once the plan is set, the investment strategy should be deployed over several months or longer to take advantage of “dollar cost averaging.” Dollar cost averaging invests smaller, fixed amounts over time to reduce the initial volatility and possible investment price declines. This technique also helps to mitigate behavioral errors that can lead to “buying high and selling low.” Empirical research has shown behavioral errors have led to returns over 2% points lower per year vs. indices as investors override their plan and strategy out of greed or fear.

Core Steps Outline:

- Engage with SEC registered investment advisor, Essential Partners, to forecast your financial situation prior to the business sale.

- Plan Trust & Estate and tax strategies with Essential Partners prior to signing an LOI (Letter of Intent).

- Transfer the post-sale cash proceeds to be managed by Essential Partners, while avoiding low FDIC protection limits of $250,000 at banks.

- Essential Partners will invest the cash into U.S. Government guaranteed short-term bonds to earn 5%+, which is also Warren Buffett’s preferred safe investment for Berkshire Hathaway’s cash.

- Follow the Essential Partners Client Partner Process now that the cash proceeds are safe and earning interest (process graphic below).

Investment advisory services offered through Essential Partners, an SEC registered investment advisor. This document contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed will come to pass. Investing in financial markets involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.