What is your compass to traverse global financial markets and how does that translate to your portfolio? Do you own investments that perform well in all four economic environments?

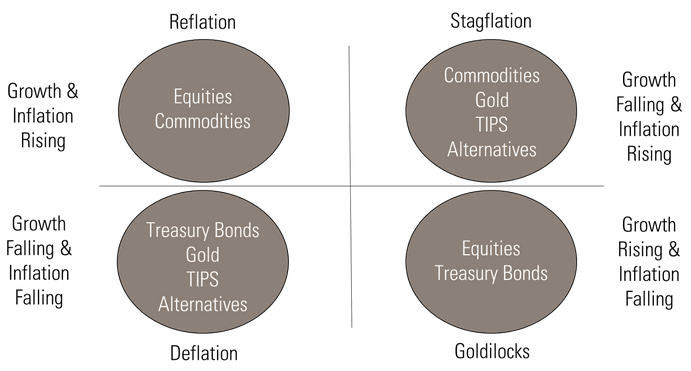

There are two core marcroeconomic variables that drive financial market changes; GROWTH and INFLATION. Consider a simple micro example as it relates to equities/stocks:

Sales growth is improving at a faster rate than the business owner anticipated while costs are growing slower vs. expectations. What would this change in expectations lead to for the overall business cash flow and resultant value of that business? Of course this would be positive!

If we apply this example over an entire economy and stock market, this would be a highly favorable environment. This is known as “Goldilocks” after the old fable and passage, “not too hot, not too cold” as growth is improving but is not strong enough to lead to inflation that could dent profits.

Now consider the reverse. A surprising slowing of sales growth while costs are increasing more than expected. It’s obvious that this would be negative for the cash flows and value of that business. This environment is commonly known as “Stagflation,” which is bad for stocks (recall the 1970’s). In this environment, long term US Treasury Inflation Protected Securities (TIPS) perform well as the value of the bond is adjusted for inflation to protect your purchasing power. Further, since growth expectations are falling, changes in nominal interest rates are primarily due to inflation, which are protected with TIPS. Commodities such as oil, industrial metals and agriculture typically perform well as they are the underlying source of the rising costs.

While Stagflation is bad for stocks, a worse environment is “Deflation,” typically characterized by growth expectations that are falling so rapidly that they pull inflation expectations down as well. Deflation has historically been the worst performing environment for stocks and the best for long term US Treasury bonds.

The most recent period of “Deflation” was the Covid induced panic of early 2020. As you recall, stocks declined >30% in early 2020, which was likely a painful period for the vast majority of investors. However, long term US Treasury bonds appreciated 27% while long term Treasury Inflation Protected bonds appreciated 18%. Not only did these two classes of bonds provide insulation relative to the stock market decline, they provided the dry powder needed to increase investments into the stock market when stocks were on sale.

What investments did you own that performed positively during this period and do you own either of these asset classes to protect against an uncertain future?

Please refer to the graphics below for a visual depiction of the aforementioned dynamics.

1Returns of IVV, VGLT, LTPZ

Investment advisory services offered through Essential Partners, a registered investment advisor. This document contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed will come to pass. Investing in financial markets involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.