- What is an unsustainable capital structure? Translation: Too much debt.

- How have the Fed’s interest rate increases impacted private businesses with high debt levels?

- What is the opportunity for patient investors?

One of the most well-known quotes from one of the greatest marketers (and investors) of all time…

“You never know who’s swimming naked until the tide goes out.”

– Warren Buffett

Consider an oversimplified example:

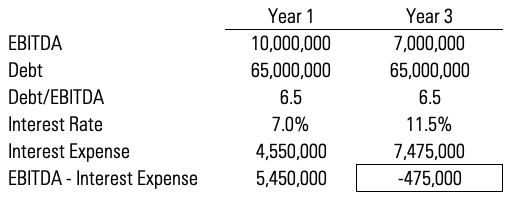

- A private equity firm acquires a business that produces $10 million of EBITDA.

- The transaction is financed with debt equivalent to 6.5x EBITDA or $65 million, with an interest rate that is variable based on SOFR (essentially Fed funds rate) + 600 bps.

- SOFR of 1% + 600 bps is a 7% interest rate in this example, which is $4.55 million of interest expense ($65 million * 7%).

- However, after the Fed’s interest rate increases, SOFR is now nearly 5.5% and the company’s interest rate is 11.5%! This leads to an interest expense of $7.5 million.

- Now further imagine the business has been impacted by economic or competitive forces or a lost material customer that causes EBITDA to decline 30% to $7 million. Keep in mind this was a $10 million EBITDA company, which is tiny and carries large sustainability risk…it’s not Microsoft!

- $7 million of EBITDA vs. $7.5 million of interest expense is a problem.

The example above can lead to compelling investment opportunities. For instance, the private equity firm might conclude the lower level of EBITDA also deserves a lower valuation multiple, hence, their equity ownership interest is virtually worthless. This type of situation presents an opportunity for new capital to restructure the debt and acquire the equity at a distressed value.

At Essential Partners, we are not anti-private equity nor are we predicting a private equity bust. In fact, we have a lot of respect and friends in the industry and admire the historical record of many firms. Zero interest rate policy can lead to a gross misallocation of capital and too much debt across asset classes (real estate also comes to mind). Essential Partners invests a portion of our client partners’ capital opportunistically in strategies that will benefit from unsustainable private market capital structures.