- Are you aware that “high yield bonds” finally have “high yields” recently >9%?

- What are credit investments and what is the opportunity?

- Does it make sense to bother when I can get >5% yields in short-term U.S. Treasury bonds?

- If I own investments with high current income, should I own them in a taxable or tax-deferred account?

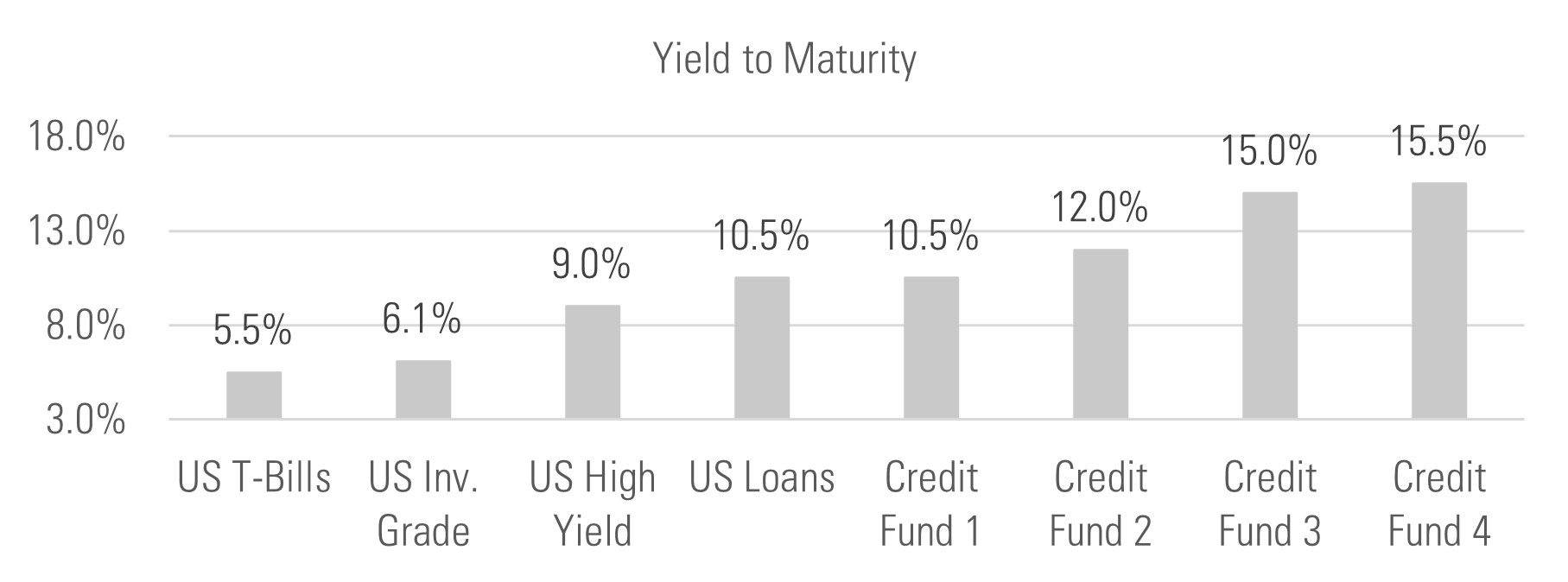

Short-term U.S. Treasury bonds yielding over 5% have appeal but the dynamics in high yield corporate bonds and other credit/debt investments have changed drastically over the past few years. These dynamics have led to the overall high yield bond market yielding over 9% recently and other credit-oriented opportunities over 11-15% on a yield to maturity basis. “Credit” is defined by any type of investment in another entity’s debt such as corporate bonds, direct private lending, asset backed lending, mezzanine debt, commercial real estate debt, distressed debt, etc.

In our estimation, the current return opportunity among credit investments is in excess of historical U.S. stock market returns (~10%), while taking less risk as debt holders get paid before stockholders. In other words, if bond holders don’t get paid interest and principal, stockholders typically get zero. Further, credit investors control bankruptcy restructurings, which for high yield bonds, has historically led to a 40% recovery rate, even in the case of default (historical default rate of ~2-3%). In the example of commercial real estate, “owners” return the property to lenders when they can no longer pay the interest and lenders own the property, which can then be sold to recover their debt/credit investment.

How did we get here? Consider the high yield bond market; this category of bonds has returned only 3% over the past 10 years, which is a historically weak period vs. the 9% return earned over the prior 26 years (1986-2012). This lackluster decade of performance is due to two primary factors. First, the Federal Reserve suppressed their “Fed Funds Rate” below 2% in 76% of the months over the past 10 years and below 1% in 58% of the months. Further, the rapid rise from 0% rates in early 2022 to over 5.25% currently causes the price of all bonds to go down, all else equal. At the beginning of 2022, the ”high yield” bond market offered a “low yield” of 4.25%.

Another critical aspect to consider is what account type to hold high-yield, high-income investments. For instance, tax-advantaged accounts such as an IRA, Roth or 401k provide a material advantage for credit investments given their high current income. The account location should also be aligned with the overall personal and investment strategy.

At Essential Partners, we do not take static views of asset classes and credit investments are no different. Two years ago, high yield bonds offered low yields, which held no appeal to us. Currently, we are investing a portion of our client partners’ capital opportunistically in credit-oriented strategies while maintaining dry powder for additional credit investments as we remain mindful of the risks, particularly as the economy slows.

This presentation contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed in this presentation will come to pass. Investing in the stock market and credit investments involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Essential Partners, LLC does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance.