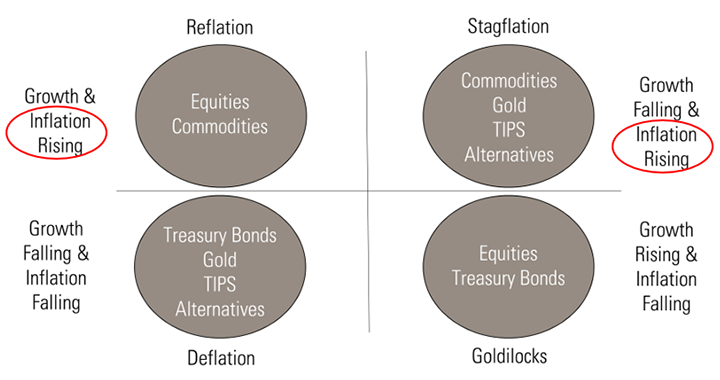

The future is uncertain is one mantra we live by at Essential Partners. For this reason, we humbly design portfolios that are resilient to the Core Four Economic Environments as defined by the rate of change in economic growth and inflation. Our client partner’s personal situation and objectives come first but the Core Four seeks to not only maximize investment returns but also peace of mind. The time horizon is measured in years, not weeks, months or any given 12-month period.

We favor frameworks because they create discipline. Our Wealth Allocation framework starts with a client partner’s personal situation, layers on the Core Four and applies tactical opportunistic adjustments on a cyclical (4-10 years) and secular (through multiple cycles) time horizon. Extreme tax mitigation is another mantra that permeates our process.

We are frequently asked what we think of “the market” or “economy.” As a 20+ year global investor, my mind immediately thinks, “which one?” Would it surprise you that the German stock market has outperformed the S&P 500 since the fall of 2022 despite a German economy that has languished (effectively zero growth for 2 years) and has been virtually cut off from its previously ultra cheap energy source of Russian natural gas?

Would it also surprise you that Emerging Markets and International Developed Markets indices have outperformed the S&P 500 and Nasdaq in this past quarter? This is not a prediction that this will continue but given disparities in valuation, sentiment and policy, some diversification is wise.

We are ardent supporters of diversification, but our client partners’ largest category of investments remains U.S. stocks.

Generally, the U.S. economy continues to produce good growth. Nominal GDP was nearly 6% last quarter and real GDP 3% after deducting inflation. There are two paths that present risks; 1) the rate hikes over the past few years have a delayed economic response, which causes the economy to weaken or 2) the recent 0.5% Fed rate cut and guidance of more to come provides additional stimulus, which causes the economy to strengthen further. I see the latter as more likely, but why is this a risk? Inflation.

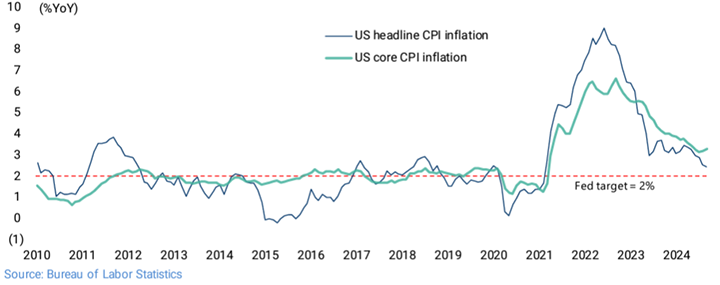

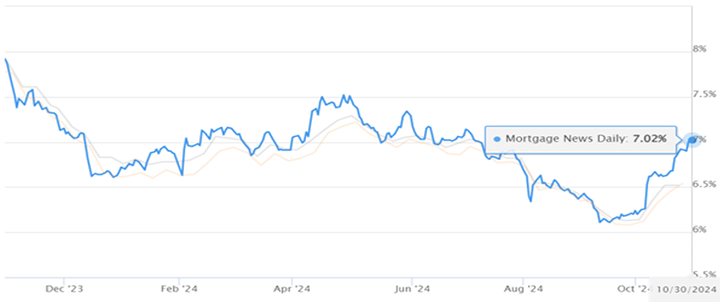

I view the odds of stickier or higher inflation as a material risk. Our government’s large fiscal spending programs, leading to war-like budget deficits, are supporting the economy as well, further stoking demand and inflation. It is not intellectually consistent for stocks, homes, gold, bitcoin and government debt to be at all-time highs and core CPI to be above 3%, yet the Fed is cutting rates. This could further inflate financial assets and the price of goods and services. The bond market is getting the message as longer duration U.S. government bonds have seen a material increase in interest rates since the Fed lowered short term rates as the 10-year interest rate increased from 3.65% to 4.25% sending mortgage rates up from 6.1% to 7%.

10-Year U.S. Government Interest Rates

30-Year U.S. Mortgage Rates

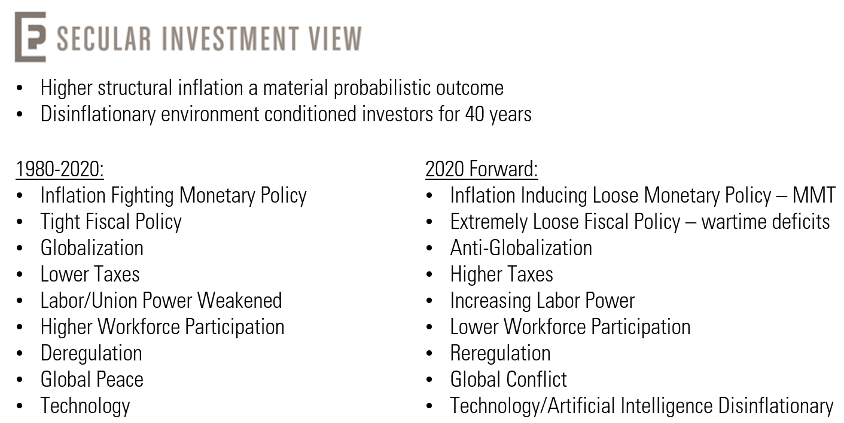

Within our Wealth Allocation framework, we view inflation on a cyclical and secular timeline. On a cyclical basis, inflation has come down as the Fed increased rates and supply chains worked themselves out post-Covid. However, it is likely that inflation has bottomed on a cyclical basis and on a through-cycle or secular basis, I expect higher inflation as well. Consider the slide below from our investor presentation that outlines the conditions that existed from 1980 – 2020 and how those factors have been reversing over the past 4 years as we recognize the present conditions. Will the disinflationary force of technology driven by Artificial Intelligence bail us out? Is inflation needed or desired to prop up nominal GDP above annual fiscal deficits as this is the only way for U.S. debt to GDP to decline (a.k.a. inflate the debt away)?

As a refresher, the Core Four economic environments are depicted in the graphic below. Based on this framework, the top two quadrants display the investments that typically outperform when inflation is rising ahead of existing expectations. After living in a “Goldilocks” environment for most of the last 2 years, the probability of Stagflation and Reflation is rising.

Our client partners continue to have investments across assets that are likely to perform well in inflationary environments. Gold is up 32% so far this year, easily outpacing the S&P 500 but after a 15-year compounded annual return of 14% for the S&P 500, any investments outside that index look foolish. Keep in mind, gold is up 9.5x over the last 25 years vs. 6.5x for the S&P 500. The chorus of “stocks for the long-run” or “time in market is more important than timing the market” grows louder and more consensus each day. Those arguments have merit but the risk/reward over the next few years is tilted towards a higher degree of risk. We are tilting toward credit-oriented investments such as private loan funds which offer “equity-like” returns with less risk, idiosyncratic capacity constrained strategies such as Japanese shareholder activism, distressed private investments (debt & equity) and tax-mitigating strategies to reduce capital gains and/or ordinary income taxes.

I will close with my conclusion from last quarter as a review, “The economy in the U.S. is now slowing yet inflation remains well above the Fed’s target of 2%. The data coming out suggests a stagflationary environment where economic growth disappoints to the downside and inflation is higher than expectations. In this version of our Core Four Economic Environments, stocks typically do not fare well yet those that do are typically high quality and high growth companies. Thus, it would not surprise me to see the large-company technology dominance continue for at least a few more quarters.”

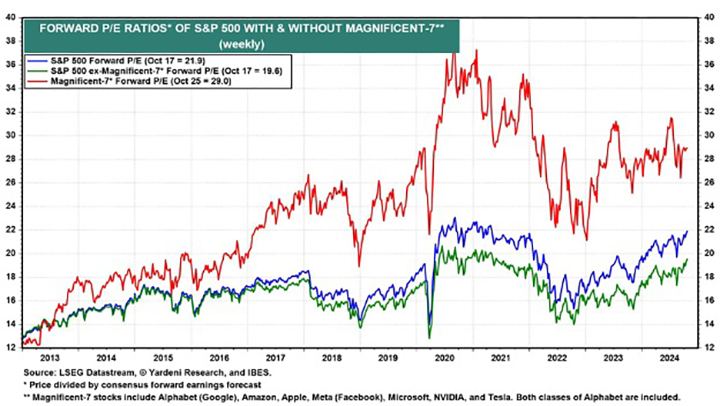

The prior commentary has largely held true yet on a forward-looking basis, I worry about the sustainability of outperformance. The “Magnificent-7” now trade at nearly a 30x price to earnings multiple vs. the S&P 500 of 20x, excluding the Mag-7. This is a 50% premium and similar valuation disparities have historically proven difficult, yet not impossible to maintain, most recently in 2021.

I appreciate your continued trust and support.

Nick

Compliance Disclosure:

Investment advisory services offered through Essential Partners, LLC, an SEC registered investment adviser.

This presentation contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed in this presentation will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Essential Partners, LLC does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance.

Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind, including, without limitation, no warranties regarding the accuracy or completeness of the material. This information is subject to change, and although based on information that Essential Partners, LLC considers to be reliable, it is not guaranteed as to accuracy or completeness. Any market data is provided “as is” and on an “as available” basis. Source information, such as security prices, dividend rates, etc., is obtained from independent financial data suppliers.