- Do you know that in 2 of the last 5 decades, stocks produced negative real returns vs. cash?

- What assets do you own that perform best in the decades when stocks perform worst?

- Do you own any assets that will perform well when inflation is high but economic growth is low?

“Gold is money, everything else is credit.” – J.P. Morgan

There are some investors who are known as “gold bugs.” These investors passionately advocate for gold as the only investment holding with merit. We are not gold bugs, nor do we take myopic views of asset classes.

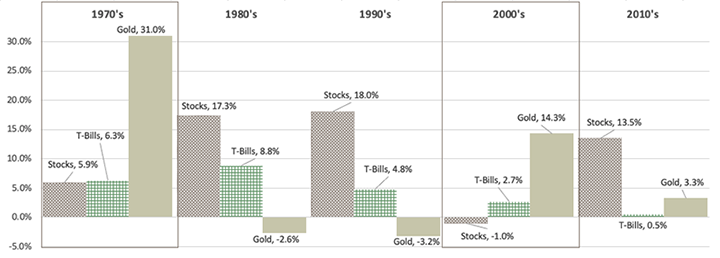

However, we believe that gold can play an important role in investor portfolios. For instance, gold prices typically peak when financial assets, such as stocks, are troughing. The chart below presents the annual returns of the U.S. stock market (S&P 500), T-bills (cash equivalent) and gold for each decade since 1970. In 1971, President Nixon ended the convertibility of U.S. dollars into gold. This effectively allowed the price of gold to float freely in U.S. dollar terms and it has appreciated at a compounded annual growth rate of 8% from 1970 – 2021 vs. 11% for the S&P 500.

From 2000 to 2010, stocks not only underperformed cash by 3.7% annually, but the absolute return was negative 1% annually over an entire decade. $100,000 invested in stocks in 2000 led to $90,400 in 2010. Meanwhile, gold returned over 14% annually so a $100,000 investment in 2000 increased to over $380,000 by 2010. Based on the data, it’s fairly obvious that gold does well for long periods when stocks perform poorly and vice versa. Considering stocks are most people’s largest investment holding, gold can provide insurance when the S&P 500’s performance is bad. The most recent example was the Covid induced stock market crash in the first three months of 2020 when the S&P 500 was down more than 30% and gold was up nearly 10%. Gold does well in this type of environment when economic growth and inflation are declining relative to expectations (a.k.a. Deflation).

Further, gold has maintained its purchasing power over decades and particularly when inflation is high and economic growth is low vs. expectations (a.k.a. Stagflation). This is in contrast with 2021 when gold confused “many” investors with poor performance (+2.5%) relative to the S&P 500 (+28%) and proclaiming the death of gold. It was no surprise to us considering that gold does not typically perform strongly when inflation and growth are higher than expectations (a.k.a. Reflation) as that environment is beneficial for stocks and commodities.

Please refer to our past commentary on the “Core Four Economic Environments” for further insights on Reflation, Stagflation, Deflation and Goldilocks.

Core Four Economic Environments by Essential Partners

Investment advisory services offered through Essential Partners, a registered investment adviser. This document contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed will come to pass. Investing in financial markets involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security and although based on information that Essential Partners considers to be reliable, it is not guaranteed as to accuracy or completeness. Any market data is provided “as is” and on an “as available” basis. Source information, such as security prices, dividend rates, etc., is obtained from independent custodians (e.g., Charles Schwab, Inc., etc.) and independent financial data suppliers (Morningstar, Interactive Data Corporation, etc.).

Sources: Stern NYU Historical Returns; LBMA Gold Price USD; Essential Partners Time Weighted CAGR calculations for each period