- What is the “Money Illusion?”

- How can the concept of the Money Illusion relate to investment returns in the current environment?

- What is your framework to manage risk in periods when investment return interpretation can be distorted by the Money Illusion?

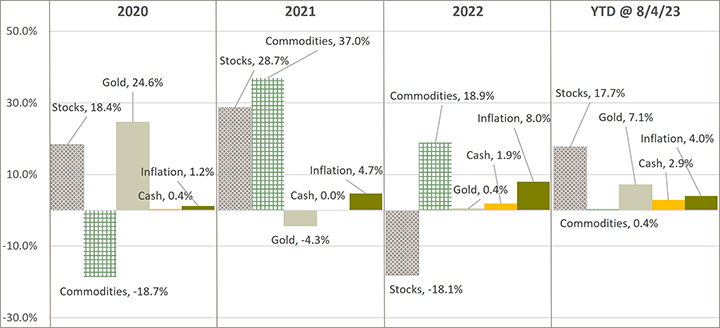

The recovery of the S&P 500 in 2023 has been swift. Since the beginning of 2022, the total return of the S&P 500 is -4% yet Cash is up 5%, Commodities are up 19% and Gold is up 8%. How can we relate the concept of the Money Illusion to contextualize these results?

Economist Irving Fisher developed the concept of the Money Illusion, which refers to a cognitive bias where money is thought of in nominal, as opposed to real terms. In other words, people view changes in prices or wages without considering the impact of inflation or actual purchasing power. For instance, a 4% pay raise should be viewed differently if inflation is 6% vs. 2%.

Financial markets, businesses and economies can be increasingly confusing and complex during inflationary periods. While not a traditional application, the Money Illusion provides an interesting lens to view investment returns.

For instance, when people think of the decade of the 1970’s, it is generally believed that the performance of the S&P 500 was awful. Stocks had a compounded annual growth rate of approximately 6% for the entire decade. While this is not outstanding, 6% does not sound too bad. This is the Money Illusion at work since in the 1970’s, cash and inflation grew at a compounded annual rate near 7% for the decade. Thus, stocks produced a negative “real” return when compared to cash or inflation.

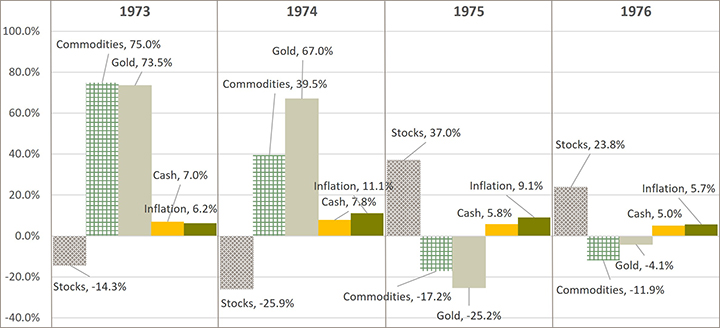

Further, a broad commodity basket produced a compounded annual growth rate of 21% per year during the 1970’s and the price of gold was up 31% annually for the decade. 6% annual stock returns are in fact awful when compared to “real assets.” Within the 1970’s, commodities and gold performed best in the years stocks performed the worst (1973 & 1974) and vice versa (1975 & 1976), demonstrating compelling diversification benefits (graphic below).

At Essential Partners, we are not myopic U.S. stock market perma-bears, commodity super-cycle bulls or gold bugs. In fact, our client partners have material investments in U.S. public equities. However, our risk management framework focused on the Core Four economic environments dictates that we have some investments in “real assets,” which provide compelling diversification benefits. Further, we invest in private and public investment strategies that seek to provide idiosyncratic returns, regardless of the environment. Our approach seeks to prudently manage risk to protect and grow our client partners’ hard-earned capital.

For further illustration, the graphic below provides additional details on returns from 2020 through August 4, 2023. Please refer to our article, Core Four Environments: Portfolios Lack True Diversification, for perspective on our foundational asset allocation philosophy.

Investment advisory services offered through Essential Partners, an SEC registered investment advisor. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results. Investing in financial markets involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Sources: Minneapolis Fed, S&P, COMT, Stern NYU Historical Returns; S&P GSCI TR USD Index, LBMA Gold Price USD, Essential Partners Time Weighted CAGR calculations for each period