2023 was an intriguing year in that many indicators were flashing recession, yet the economy was resilient while inflation collapsed. We happily spend our time exhaustively analyzing data and mitigating risk, so our client partners can spend time enjoying their personal pursuits. The underlying data showed there was a tug of war between high fiscal […]

Are you aware that “high yield bonds” finally have “high yields” recently >9%? What are credit investments and what is the opportunity? Does it make sense to bother when I can get >5% yields in short-term U.S. Treasury bonds? If I own investments with high current income, should I own them in a taxable or […]

Are you charitably inclined? If not, no judgement here, but stop reading. We have other ideas for you. Do you have annual tithing commitments to your church? What is a Donor Advised Fund? Are you planning on selling your private business but face a large tax bill? Philanthropy can be an important strategic aspect of […]

What is an unsustainable capital structure? Translation: Too much debt. How have the Fed’s interest rate increases impacted private businesses with high debt levels? What is the opportunity for patient investors? One of the most well-known quotes from one of the greatest marketers (and investors) of all time… “You never know who’s swimming naked until […]

What is the “Money Illusion?” How can the concept of the Money Illusion relate to investment returns in the current environment? What is your framework to manage risk in periods when investment return interpretation can be distorted by the Money Illusion? The recovery of the S&P 500 in 2023 has been swift. Since the beginning […]

Have you considered the mindset and thought process differences between operating a business for personal cash flow vs. earning an investment return? Have you performed a comprehensive financial forecast for you and your family considering your financial situation post-sale? Do you understand your investment options and a range of investment returns? Is your nest egg […]

Why should I care about investing in Japan? That sounds risky! What is shareholder activism? How is the opportunity in Japan like Private Equity in the U.S. in the 1980’s? “I am delighted to have Berkshire Hathaway participate in the future of Japan.” – Warren Buffett I made my first investment in a Japanese stock […]

Are you planning on selling your private business but face a large tax bill? What is a Qualified Opportunity Zone or Qualified Opportunity Zone Fund? Do you understand how to increase your long-term tax efficiency while investing in real estate? “Taxes are killing us, but I don’t know all the strategies.” – Anonymous Pest Control […]

Does the changing landscape of estate tax exemptions concern you? Are you seeking a flexible and strategic approach to secure your estate for your beneficiaries? Does the idea of losing access to your financial resources worry you when considering estate planning strategies? Are you interested in reducing your estate tax liability while maintaining access to […]

David Senra is an animal and I love his podcast, “Founders.” Senra is authentically enthusiastic about studying historically significant founders and his pursuit makes me recall Charlie Munger’s thoughts on this process. “I make friends with the eminent dead.” – Charlie Munger The Founders podcast consists of Senra reading a biography of a founder, analyzing, […]

Does putting a large amount of your investments in a trust seem like too large of a commitment all at once? Are you comfortable giving investments and cash annually to your children without controlling how the money is utilized? Are you worried about losing control of your assets by putting them in a trust? Is […]

Are you planning on selling your pest control business but face a large, painful tax bill? Have you sold your business and rolled equity that you plan to sell for a gain? Are you aware of institutional investment strategies that could lead to >20 cents of tax savings on each dollar invested? Or substantially more […]

Do you know the true cost of holding excess cash in your business bank accounts? Would additional capital be helpful to fund your business growth while taking less risk? How many more team members could you hire (or not fire) if you earned more interest on your cash? Does your bank salesperson have any incentive […]

As of September 30, 2022, the current year is the worst start for bonds since 1926 as the overall U.S. bond market is down nearly 15%. While this is disappointing, it also creates a unique, once in a generation, tax loss harvesting opportunity. This strategy can reduce current and future taxes. Tax loss harvesting is […]

Do you have high, excess cash in your business cash account earning close to 0% interest while inflation is recently greater than 6%? Do you find traditional alternatives such as CDs or money market accounts similarly unattractive given interest rates 1% to 2% and long commitment periods greater than 1 year? Do you understand your […]

Which investment solutions that you own will perform well in an inflationary environment? At Essential Partners, we build portfolios for all types of economic environments, including rising inflation. Despite inflation being littered across the news and social media daily, the past 40 years have conditioned individual and institutional investors to not worry about inflation. This […]

What is your compass to traverse global financial markets and how does that translate to your portfolio? Do you own investments that perform well in all four economic environments? There are two core marcroeconomic variables that drive financial market changes; GROWTH and INFLATION. Consider a simple micro example as it relates to equities/stocks: Sales growth […]

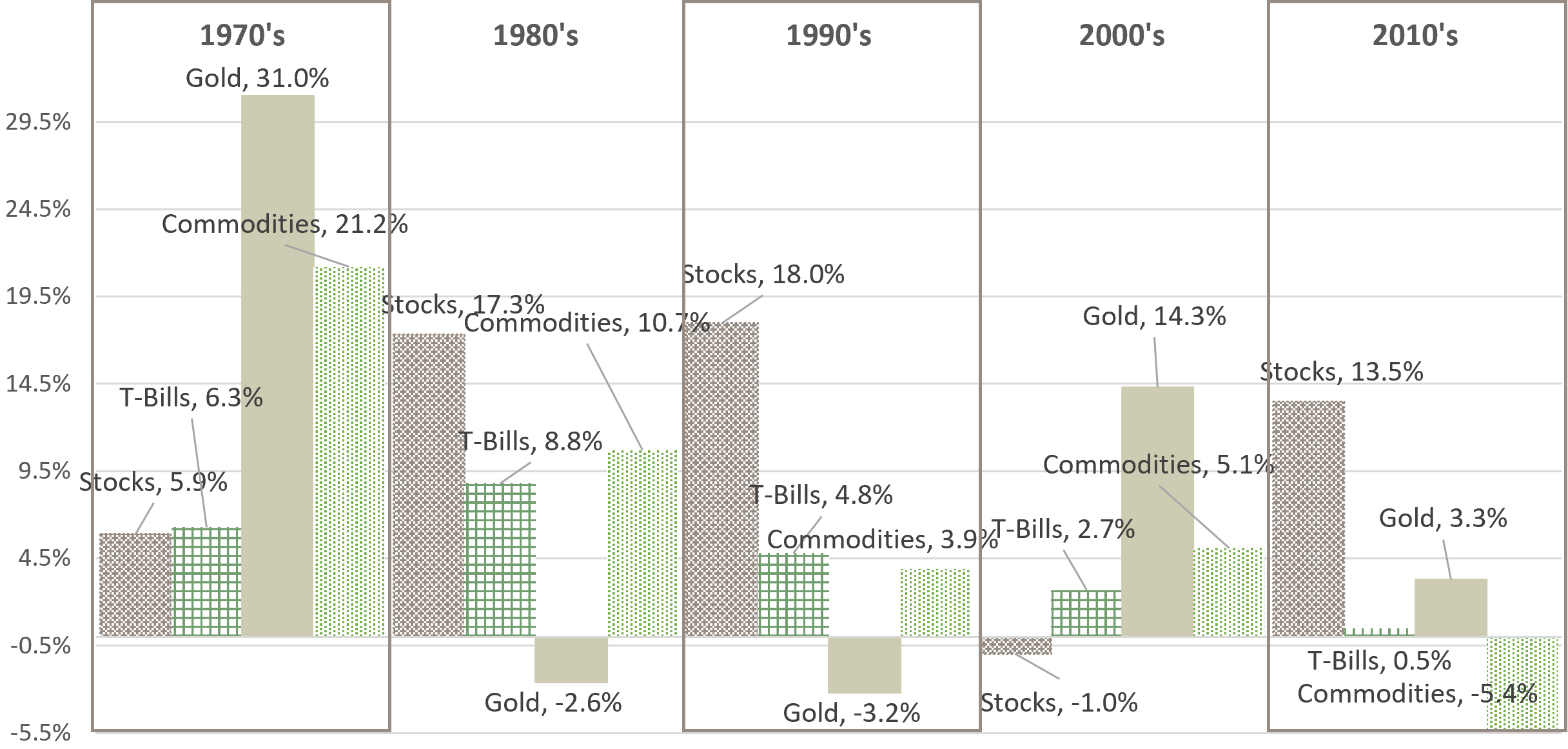

Do you know that in 2 of the last 5 decades, stocks produced negative real returns vs. cash? What assets do you own that perform best in the decades when stocks perform worst? Do you own any assets that will perform well when inflation is high but economic growth is low? “Gold is money, […]

Investment portfolios that are balanced to various economic and inflationary environments will at times contain certain holdings with unrealized capital losses. Tax loss harvesting is a tactical portfolio strategy to sell these holdings to capture the capital losses, which can then be used to offset the capital gains realized elsewhere in the portfolio. Further, the […]

Do you know the true cost of your investment holdings? Does your salesperson/broker receive commissions? Does your salesperson’s firm capture any special distribution or marketing fees at your expense? Does your salesperson have sufficient training? Does your “robo-advisor” force you to hold too much cash? Warren Buffett’s partner Charlie Munger is famously outspoken regarding the […]

Do you have a disciplined process and documentation for your investment strategy? Does your salesperson/broker provide an Investment Policy Statement to set clear investment objectives, guidelines, and expectations? “Successful investment takes time, discipline and patience.” – Warren Buffett In our experience, no serious pension or endowment would invest without first creating an Investment Policy Statement. […]

Will your salesperson/financial advisor analyze investments they do not bring to you where they cannot earn fees or commissions? Has your salesperson/financial advisor ever thought your investment idea was a great idea if it meant you would be pulling the money from their control and fee structure? Has your investment advisor ever analyzed a company’s […]

2023 was an intriguing year in that many indicators were flashing recession, yet the economy was resilient while inflation collapsed. We happily spend our time exhaustively analyzing data and mitigating risk, so our client partners can spend time enjoying their personal pursuits. The underlying data showed there was a tug of war between high fiscal stimulus totaling $1.65 Trillion (Inflation Reduction Act, CHIPS, Infrastructure) and tighter monetary policy as the Fed increased rates 1% to 5.25-5.5%.

In 2023, the S&P 500 recovered its losses from the prior year. A surprising result for the latest rolling twelve-month period. Few investors were expecting such a swift recovery amidst rising rates and the old adage, “Don’t Fight the Fed.” This is another humble reminder of our mantra that “the future is uncertain.”

This humility leads to creating client partner portfolios that have some semblance of balance to the Core Four economic environments while also investing in idiosyncratic strategies that are likely to generate returns regardless of the environment (shareholder activism, quantitative long/short, multi-strategy, distressed private opportunities, hedged credit, etc.). Our approach leads to greater peace of mind due to lower volatility, which produces fewer cognitive misjudgment errors. Not “selling at the bottom” or aggressively “buying at the top” results in our client partners reaching their long-term financial objectives.

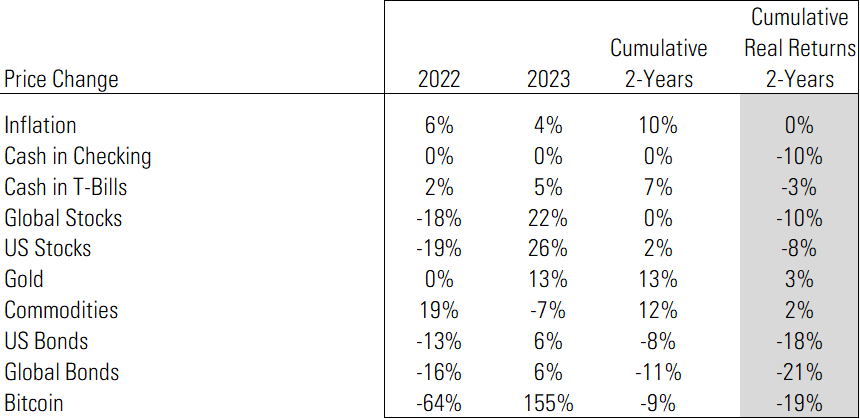

For instance, consider the cumulative performance figures for a broad selection of asset classes over the past two years beginning 1/1/2022. Of particular note, is the right-hand column, which displays “Real Returns” over the two-year period or put another way, returns after subtracting inflation. The only two asset classes with positive real returns were gold and commodities. Not only were these two asset classes positive vs. inflation but their performance was uncorrelated to most investors’ largest holding, US stocks. For instance, US stocks were down 19% in 2022 yet commodities were up 19% and gold was flat. This is an endorsement of diversification, not for a larger weighting in gold and commodities vs. stocks.

Zooming out further, consider the following chart showing annual returns by asset class over the past 5 decades. Let’s use commodities in the 1970’s to understand the chart data. For the 10 years in the 1970’s, commodities produced a 21.2% compounded annual return or $100 invested in commodities in 1970, grew to $683 at the beginning of 1980.

Now to the point, US stocks produced a negative “Real Return” in the 1970’s and 2000’s while gold and commodities drastically outperformed in those two decades. While this is an interesting observation, the challenging aspect of owning diversified investments is not the good times, it’s the long stretches of time, possibly years, when they underperform stocks. Gold languished for two decades after its bubble peak in 1980. Tactical adjustments matter too.

Excessive pessimism is not rewarded in financial markets in the long term. I am cautiously optimistic headed into 2024 with a greater degree of caution in the first half. This is due to difficult economic growth comparisons as we lap the superfluous fiscal spending binge of 2023. The Fed’s dot plot expects the Fed to cut rates 3 times over the coming year. I disagree, yet the path is uncertain.

If the economy is strong, no cuts are likely and interest rates remain “higher for longer” to suppress further inflationary bursts. In this scenario, a re-acceleration of inflation is likely at some point. However, if the economy falters and deflationary forces kick in, we could see the Fed funds rate go below 3% and new fiscal stimulus, sowing the seeds for the next inflationary up-cycle. The historical record of economic “soft landings” is largely non-existent, further reinforcing our approach to manage portfolio risks. Our view is that the current disinflationary forces are cyclical in what will be higher structural inflation in the current decade. For a review of our long-term view of inflation, please refer to our 2021 writings on our website: Inflation: Secular Analysis by Essential Partners

I appreciate your continued trust and support.

Investment advisory services offered through Essential Partners, LLC, an SEC registered investment adviser.

This presentation contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed in this presentation will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Essential Partners, LLC does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance.

Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind, including, without limitation, no warranties regarding the accuracy or completeness of the material. This information is subject to change, and although based on information that Essential Partners, LLC considers to be reliable, it is not guaranteed as to accuracy or completeness. Any market data is provided “as is” and on an “as available” basis. Source information, such as security prices, dividend rates, etc., is obtained from independent financial data suppliers.